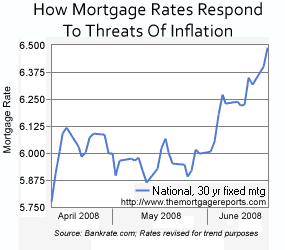

Members of the Federal Reserve turned up the inflation chatter since late-May and mortgage rates are suffering.

Even worse, it's creating a confusion among home buyers because lender pricing is expiring multiple times daily.

As a general rule, inflation is bad for mortgage rates because it cause the dollar to lose its value. When the dollar loses its value, mortgages repayments their lose value, too -- after all, we all write our checks against U.S.-based bank accounts.

So, when inflation is present, mortgage rates almost have to increase in order to compensate for devaluation.

With the frequency that Fed members are addressing inflation head-on, traders speculate that Ben Bernanke & Co could increase the Fed Funds Rate as early as its next meeting, June 24.

This may help stabilize mortgage rates, but it would cause credit card and home equity credit line to payments to rise.

0 comments:

Post a Comment