As we get closer to Labor Day, volume on Wall Street is dwindling as market players get a head start on their long weekend.

As we get closer to Labor Day, volume on Wall Street is dwindling as market players get a head start on their long weekend.Today could be a difficult day to shop for mortgage rates. Expect volatility.

This is because mortgage rates are based on the price of mortgage bonds and, on Wall Street, bonds trade a lot like stocks.

There has to be a buyer and a seller at a specific price to make a deal.

With so many traders on vacation today, though, there are fewer opportunities to match buyers and sellers. This can cause mortgage prices rise or fall faster than on a "normal" day, directly leading to mortgage rate volatility.

For a light-volume trading day, there is a lot of information for markets to digest, including:

* The weather reports on Tropical Storm Gustav.

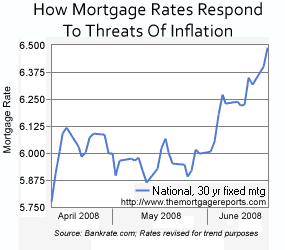

* Reports that inflation is rising.

* Reports that Consumer Spending is slowing.

* Ongoing political tension between the U.S. and Russia.

By themselves, each of these points can move markets. Together, however -- and aided by Labor Day -- they can move markets a lot.

Mortgage bond pricing is fluid, changing every minute of every day. Today, those changes will be exaggerated and, as an example, in the first 30 minutes of trading, mortgage rate pricing swung from rate improvement to rate deterioration in a flash.

.bmp)